[ad_1]

YouTuber Stephen “Coffeezilla” Findeisen published some eye-opening research earlier this year about Logan Paul’s CryptoZoo, an NFT blockchain project that Paul, an aspiring rapper, boxer and philosopher, described as “a really fun game that makes money.”

Surprisingly, the whole thing turned out to be a scam, but not before the “players” of the game, who were usually young men, ended up losing millions of dollars. Paul is now the defendant in a class action lawsuit by CryptoZoo players, but why did so many people agree to him in the first place? It does not seem exaggerated to believe that a lack of financial education contributed to his victimization. CryptoZoo only sounds as something to stay away from, if you have at least some financial education.

But the paucity of financial literacy in the US also helps explain broader economic problems, like why Americans have a combined $1 trillion in credit card debt, why so many people are afraid they don’t have enough money to retire and why become victims of predatory credit practices.

you don’t know what you don’t know

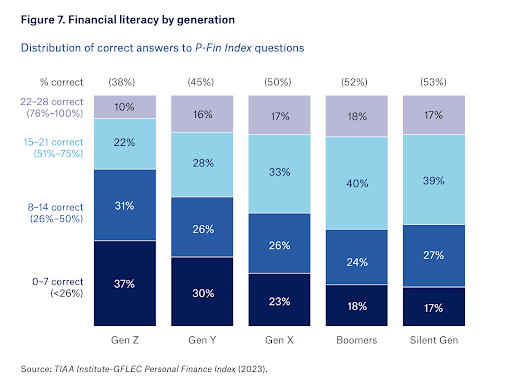

In 2017, the Global Financial Literacy Excellence Center issued its first P-Fin Index, a 28-question survey that serves as a barometer of financial literacy among American adults. It covers topics such as loans, savings, consumption, wages, access information sources, investments, insurance, and understanding risk.

Since its inception, the results have generally been poor. According to the latest findings, Americans were only able to answer 48% of the questions correctly:

- Gaps in financial literacy extend across genders, races, ethnic groups, and generations, though they are particularly acute among Millennials (born between 1981 and 1996) and Generation Z (1997 to 2012), who answered only 37% correctly and 30%. of the questions, respectively.

- One key worrying data point is that people scored particularly low on understanding risk. On average, only 35% of these questions were answered correctly.

The center found that, compared to people with financial literacy, those without skills are three times more likely to have debt problems, four times more likely to struggle to make ends meet, and seven times more likely to spend 20 hours or more per week thinking about money problems.

As both Francis Bacon and Schoolhouse Rocky say, “Knowledge is power,” and by that standard, Americans are not in great financial shape.

rolling with the punches

Of course, knowledge alone cannot offset anxiety related to economic conditions, for example the current focus on high inflation and constant rate hikes:

- Bloomberg recently surveyed 1,000 Americans who earn at least $175,000 a year and asked them if they were poor, well off, or rich. A quarter of those surveyed, some of whom earn more than $5 million a year, said they were poor or just getting by. Reporters Claire Ballentine and Charlie Wells posit that if those at the top aren’t satisfied with their financial well-being, the rest of us might be giving up hope of any upward mobility.

- The percentage of Americans who believe they are on track for a comfortable retirement is also declining, according to a BlackRock survey. The percentage of people who said they were comfortable having the retirement lifestyle they want fell to 56% from 68% just two years ago, with people citing market volatility, high inflation, recession and just plain old. lack of income as main fears

Beyond the ‘Personal’

Many factors contributed to the 2008 housing crisis, including poor government regulation, careless credit rating agencies, and predatory mortgage lending. However, personal finances played a role in the economic quagmire:

- To keep riding the massive wave of global investment in mortgage-backed securities (MBS), lenders have made record amounts of loans to people with bad credit and unstable incomes. They targeted people with little financial education, communities of color, and immigrants desperate to start a life in America.

- The problem was that the new MBS were high risk and would likely default despite AAA ratings from the credit bureaus. In the first year of the crisis, an average of 700,000 American workers lost their jobs each month, and over the course of the Great Recession, 10 million people were displaced from their homes.

“While there are many causes for the economic problems facing the country, it is undeniable that a lack of financial education is a contributing factor,” according to a Treasury Department report. “Too many Americans signed home loan and other loan agreements that they didn’t understand and ultimately couldn’t pay.”

What did you learn at school today?

So how can we avoid, or at least mitigate, another 2008? If there was somewhere we could all come together for 12 years to collectively learn this kind of thing…

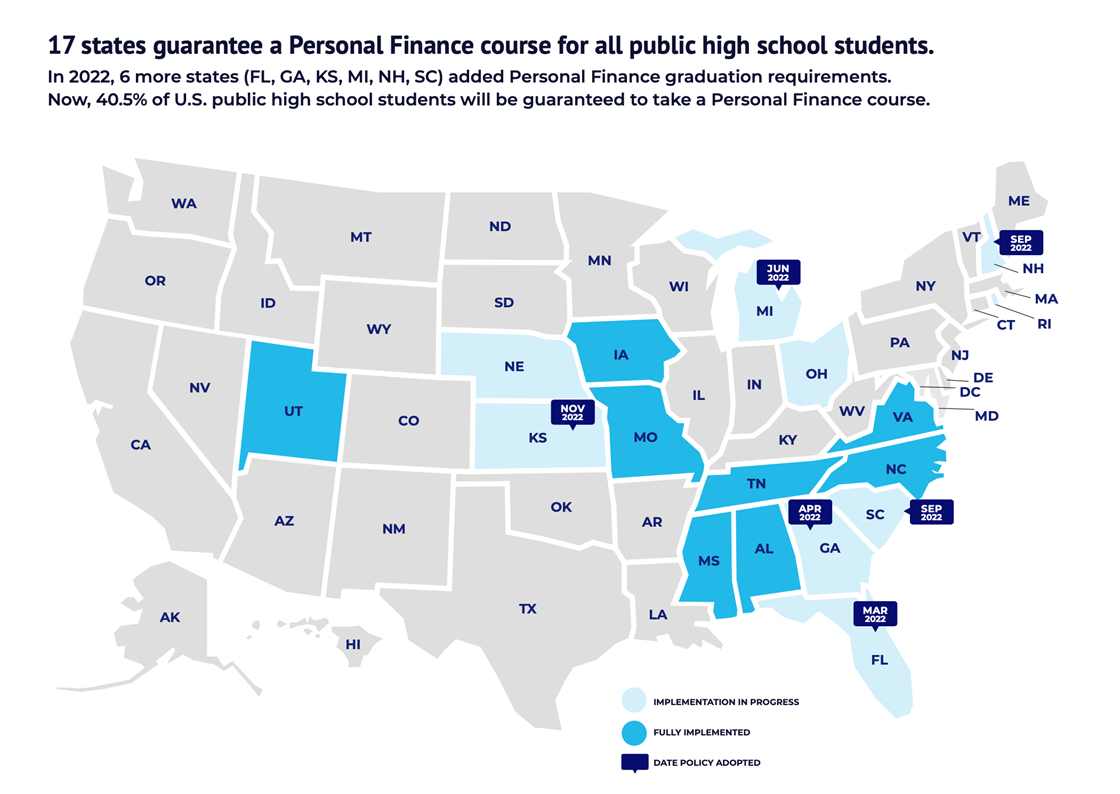

Most public schools in the US traditionally don’t teach many essential life skills: cooking, auto and home repair, stress management, and personal finance. But that could change in the next few years.

Next Gen Personal Finance is a nonprofit organization that promotes and develops financial literacy classes in high schools across the US Its goal is to have all students in the United States required to take a one-semester personal finance course by 2030 .

“The good news is that momentum is tremendous,” NGPF co-founder Tim Ranzetta told The Daily Upside. “In the last two and a half years, we have seen the number of states that require a semester course go from 8 to 23.”

The class NGPF offers to high school students covers a wide range of topics: applying for a job, reading pay stubs, buying car insurance, investing in an IRA, understanding compounding returns.

“We have an activity that teaches them how to read a credit card agreement, and many are surprised to learn that they shouldn’t just pay the minimum each month,” Ranzetta said, “They should pay it in full because the interest rates are now over the twenty%”.

In your head

Beyond technical skills, Ranzetta said much of the class is designed to build confidence and break students’ fears about money and the stock market. Individual stocks can be a gamble, and if a young person’s choices fail, they often leave thinking that any type of investment is not for them.

“Loss aversion says that when the stock market falls, you feel twice as much pain as the joy you get from the gains,” he said. “As investors, we can be our own worst enemies.”

Introducing students to the least risky index funds instills composure and prepares them for the general ups and downs of the broader market.

“The hardest thing to teach in investing is that the simplest strategy is often the best,” Ranzetta said. “Index funds are low cost right now. You don’t need to be a stock market wizard. You don’t need to be a genius. You just need to be patient and bear with the reductions that occur.”

We won’t be fooled again

At the opposite end of the spectrum, sometimes there isn’t enough fear. We see that when young people get involved in memestocks or get involved in casino-style trading apps like Robinhood. They treat investing like a video game.

Ranzetta acknowledges that social media and the Internet in general contain a lot of sound financial information that is free for the uninitiated, but it is also full of harmful ideas and scams.

“Survey after survey asks young people where they get financial advice, and in some cases 70% say they get it on TikTok. If we are not providing personal finance [knowledge]then they are susceptible to bad advice.”

So kids, the next time an influencer says that their NFT game can generate a lot of passive income after investing a few thousand dollars, it’s probably too good to be true.

#dont #money #Americans #relying #TikTok #financial #advice #possibly #wrong