A new survey conducted by the Federal Reserve Survey has brought to light concerning financial trends in the United States. The findings indicate that a growing number of Americans are experiencing loan rejections precisely when they are feeling financially stretched and tapped out. 🚫💰

📊 Survey Results: A Troubling Development

The Federal Reserve survey, which encompassed a diverse range of economic backgrounds, has highlighted the challenges many Americans are encountering in securing loans during times of financial strain. This situation is particularly worrisome, given the backdrop of economic uncertainties in recent times. 💼📉

📉 Economic Challenges and Loan Denials

As financial burdens increase and living costs continue to rise, individuals and families are facing mounting financial strain. In response, many seek loans as a potential safety net. However, the Federal Reserve’s survey reveals that a distressing number of loan applications are now being denied, exacerbating financial difficulties for those already struggling. 💔💸

📉 Credit Scores and Financial Inclusivity

Factors such as credit scores, employment stability, and debt-to-income ratios play pivotal roles in loan approval decisions. As economic instability persists, credit requirements may have tightened, leaving numerous Americans with limited options and a reduced chance of loan approval. This situation raises important questions about financial inclusivity and equal access to credit. 🏦📈

What kinds of loans are being turned down the most frequently?

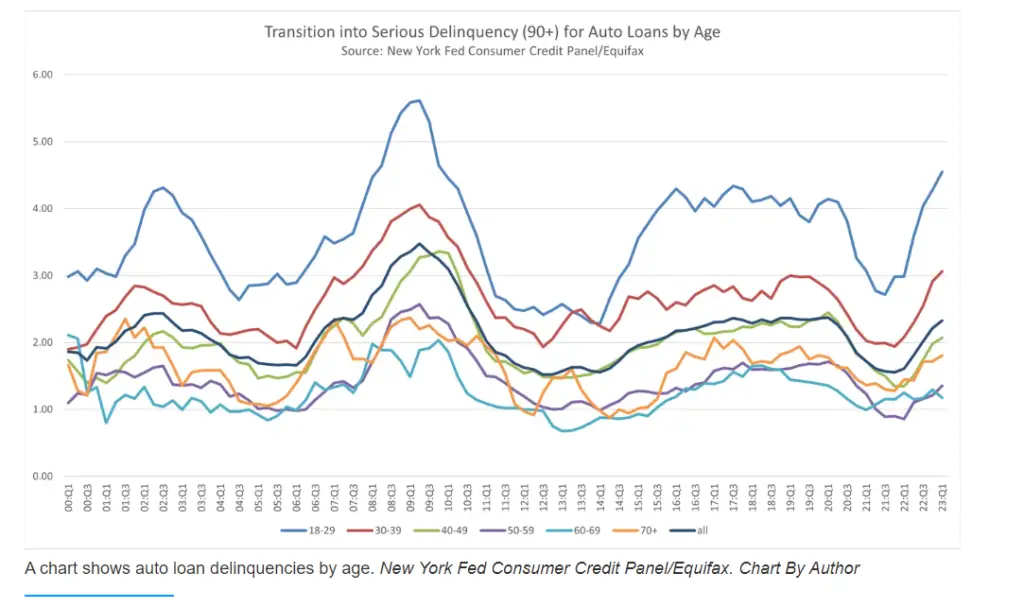

For the first time ever, the rejection rate for vehicle loans exceeded the application rate as it increased from 9.1% in February to 14.2%, the highest level since the data was initially gathered in 2013.

Alex Liegl, CEO of Tenet, which offers financing for electric vehicles, described the pattern over the previous year of banks reducing or quitting car lending as “risk aversion mode for banks.” “Banks are cutting back on lending, which is making things worse for consumers who are already under pressure.”

According to the Fed, the rejection rates for applications for credit cards, credit card limit increases, mortgages, and mortgage refinancing increased to 21.5%, 30.7%, 13.2%, and 20.8%, respectively.

What actions do customers take?

The study revealed that as interest rates increased, total credit applications decreased over the previous 12 months to 40.3%, the lowest level since October 2020 and down from 40.9% in February. However, the percentage of respondents who indicated they were likely to apply for one or more forms of credit in the upcoming year increased from 26.1% in February to 26.4%

Will fresh loan requests continue to be denied?

For all loan categories, the average reported likelihood that a loan application will be denied dramatically rose, according to the Fed. They were as follows: Credit limit increase requests went to 42.4%, the highest level since the series began; Auto loans increased to 30.7%, the highest level since the Fed began collecting this data in 2013. A data series high for mortgages, they increased to 46.1%.

🚦 Navigating Uncertain Financial Waters

For those facing loan rejections, the path ahead may seem daunting. However, there are steps individuals can take to navigate these uncertain financial waters. Seeking professional financial advice, working towards improving credit scores, and exploring alternative lending options are potential strategies to consider. 💡🌊

🤝 Supportive Community Endeavors

During these challenges, it is essential for communities to come together and offer support. Empathy and understanding can make a significant difference in helping individuals cope with financial stress. Together, we can strive for a more inclusive financial landscape and work towards ensuring that financial resources are accessible to all during times of need. 💪🤝

🔍 In-Depth Analysis Required

While the Federal Reserve’s survey provides valuable insights into the current financial landscape, policymakers, economists, and financial institutions must conduct further analyses. Understanding the underlying factors contributing to the increase in loan denials is vital in developing effective solutions for a more resilient financial future. 📚🔍

As this issue unfolds, it is crucial for Americans to remain vigilant, informed, and proactive in safeguarding their financial well-being. Let’s stand together in navigating these challenging times and strive for a future where financial opportunities are accessible to all, fostering a more financially secure and inclusive society. 💙🌟

#FinancialStrain #LoanDenials #FinancialInclusion #EconomicTrends #FederalReserve #CommunitySupport #FinancialWellbeing #InclusiveSociety #RecentStudy

FAQ:-

[sp_easyaccordion id=”226″]